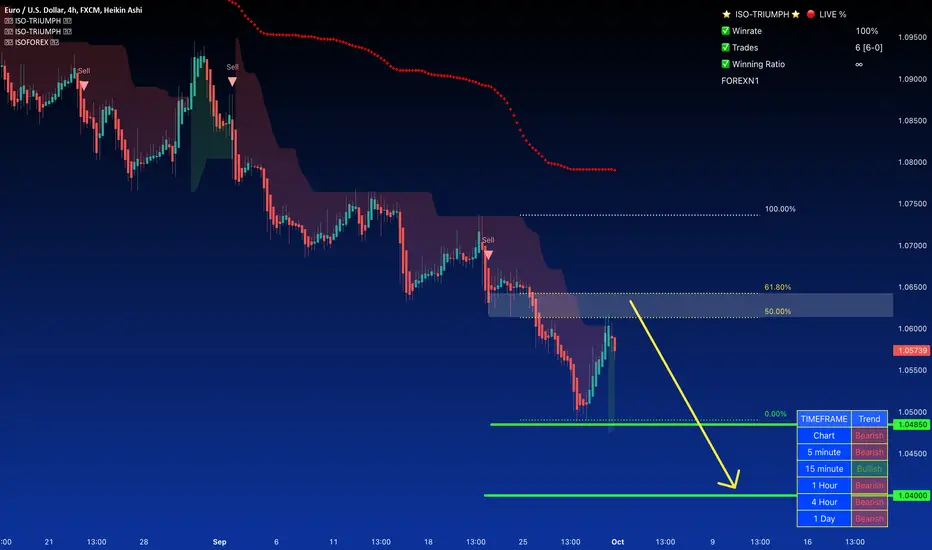

EUR/USD H4 chart – Analysis Made By REVOLVER™ and ISOTRIUMPH™ Indicators.

Inflation in both the United States and the Euro Zone didn’t ignite as expected, bringing a sigh of relief to financial markets. Yet, the US Dollar remains resilient. In the upcoming week, attention turns to key economic data, including the US ADP survey and Nonfarm Payrolls report.

The EUR/USD pair experienced a significant drop to 1.0487 during the week, marking its lowest level since early March. Investors continued to flock to the US Dollar as a safe haven. This risk-averse sentiment stemmed from central banks’ recent monetary policy decisions, where most policymakers, despite holding their fire, reiterated the persistently high inflation risks and the need for prolonged higher interest rates to keep inflation in check.

The first half of the week saw the absence of significant news, which favored the US Dollar’s strength. However, the currency faced pressure due to extreme overbought conditions and better-than-expected inflation-related data.

Cooling Inflation Trends

Germany released preliminary estimates of the September Harmonized Index of Consumer Prices (HICP) on Thursday, showing a 4.3% year-on-year increase. While this was slightly below the 4.5% expected by the market, it marked a significant improvement from the 6.4% recorded in August. Similarly, the Euro Zone HICP for the same period also came in lower than expected, with the European Central Bank’s preferred gauge of inflation rising by 4.3% YoY in September, down from 5.2% in August. The core annual HICP rate printed at 4.5%, lower than the expected 4.8% and below the previous 5.2%.

On the other side of the Atlantic, the US released the August Personal Consumption Expenditures (PCE) Price Index, the Federal Reserve’s preferred inflation measure. It showed an annual core PCE price index increase of 3.9%, a decrease from the 4.3% rate seen in July, with a modest 0.1% monthly increase.

Concerns about overheating price pressures had raised speculation about more aggressive central bank actions in the near future, heightening the risk of a significant economic downturn.

Softer Inflation Eases Concerns

However, the softer-than-expected inflation data points in the opposite direction. Central banks may maintain their recent wait-and-see stance, keeping another rate hike in reserve but hoping not to implement it.

Looking ahead to next week, the macroeconomic calendar offers several important figures. These include the September US ISM Manufacturing PMI, S&P Global’s release of Manufacturing PMIs for both the EU and the US, and later in the week, Services and Composite PMIs for both economies. Additionally, the EU will publish August Retail Sales and the Producer Price Index (PPI) for the same month. In the US, the focus will shift to employment, with the release of the September ADP survey on private job creation ahead of the Nonfarm Payrolls (NFP) report for the same month. The NFP is expected to show the addition of 150,000 new positions in September, with the Unemployment rate projected to ease to 3.7% from 3.8% in August.

– From a technical standpoint, the price appears to be in a retracement phase, with the 50% Fibonacci area and the 61.8% level potentially serving as a pullback range. This range may lead to a reversal of the pullback and a continuation of the downtrend.

EUR/USD H1 Forex chart – Analysis Made By REVOLVER™ and ISOTRIUMPH™ Indicators.

Our preference

Below 1.06850 look for further downside with 1.05500 & 1.0500 as targets

The information and publications are not meant to be and do not constitute financial, investment, trading, or other types of advice or recommendations supplied or endorsed by FOREXN1.

ISOTRIUMPH is an innovative Machine-Learning Indicator that boasts unbeatable performance! Specifically designed for TradingView to provide the best possible results in the market.

This is a Top-performing scalping indicator.

REVOLVER is a unique and revolutionary Reversal Indicator designed to pinpoint the best turning point in the market and ride the trend until the very end.

- STATE.OF.ART TOOL FOR YOUR SUCCESS -

ISOFOREX is a MT4 and Tradingview chart indicator used to identify potential reversal signals in a financial markets.

Laser-Accurate trend indicator

DISCLAIMER:

All material from forexn1.com is for educational purposes only. Trading foreign exchange carries a high level of risk and may not be suitable for all investors/traders. Past performance is not indicative of future results. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts. Forexn1.com takes no responsibility for loss incurred as a result of our trading analysis\ideas\ insights. By signing up as a member you acknowledge that we are not providing financial advice and that you are making a decision to follow\copy our trading course\analysis\ideas\insights on your own account. We have no knowledge of the level of money you are trading with or the level of risk you are taking with each trade. You must make your own financial decisions, we take no responsibility for money made or lost as a result of our analysis\ ideas\ insights or advice on forex related products on this website.

We use cookies to personalise content and ads, to provide social media features and to analyse our traffic. We also share information about your use of our site with our social media, advertising and analytics partners who may combine it with other information that you’ve provided to them or that they’ve collected from your use of their services. You consent to our cookies if you continue to use our website. Privacy & Cookie Policy